Part II - Ride the Wave

My investment playbook for navigating the markets in 2025 and beyond.

DISCLAIMER: The information provided in this article is for general informational purposes only and does not constitute financial, investment, or professional advice. Please conduct your own research and consult with a qualified financial advisor before making investment decisions.

In part one of this article, The Next Wave, I wrote in depth about the emergence of AI and Crypto, and how the two will drive direct investments in compute and energy infrastructure, and also upstream in the supply chain of materials, utilities, and more.

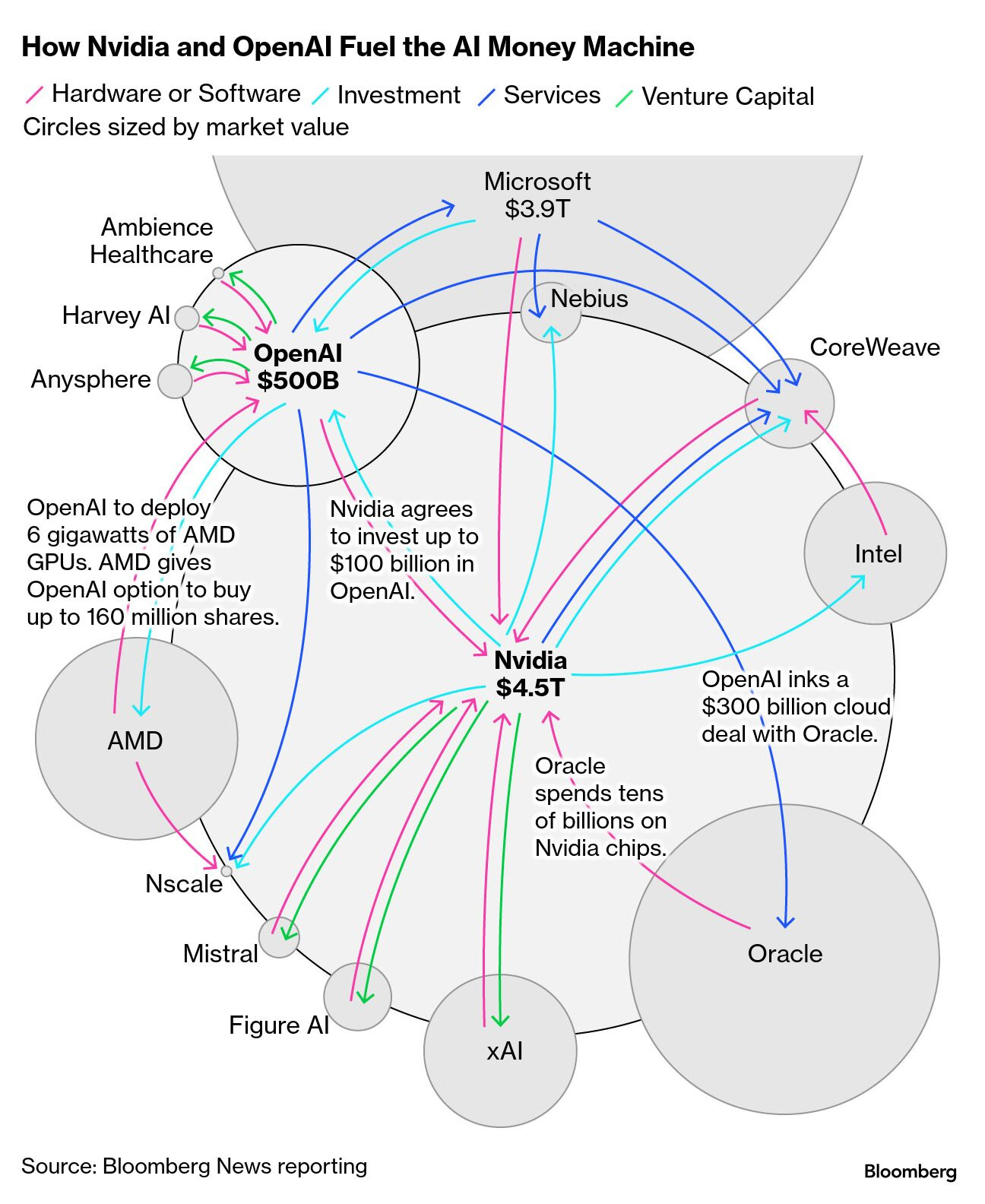

Investors are already funding hyperscale facilities, power projects, cooling systems, chip fabrication, rare earths, materials, and mining at a fever pitch.

McKinsey estimates that global AI infrastructure spending could reach $5.2 to $7.9 trillion by 2030. Deloitte estimates that power demand from AI data centers in the United States could grow more than thirtyfold by 2035.

However, at the same time, many are also questioning the circular investment frenzy and whether this flow of trillions of dollars into AI, compute, power, and data centre infrastructure is edging closer to speculative bubble territory.

Hypes fade, but assets stay

Every era of technological innovation has its excesses. But history shows that speculative manias rarely leave us empty-handed. Even when bubbles pop and markets implode, they tend to leave behind something valuable - enduring assets and infrastructure.

If we look back on history, technology bubbles have a clear pattern:

- Speculation pulls forward CAPEX and overbuilds capacity

- Market correction wipes out equity and weak balance sheets

- Sunk assets get repriced, consolidated, and reused for decades

| The bubble | What survived? |

|---|---|

| Canals (1700's) | Thousands of miles of navigable waterways that became the foundation stone of Britain’s Industrial Revolution. |

| Railways (1800's) | The rail grid, rights-of-way, bridges, and stations that connected markets, spurred urbanization, and cut logistics costs. |

| Electrification & Radio (1900's) | A nationwide electrical grid and broadcast network that defined and transformed modern 20th-century life. |

| Dot-Com & Internet (2000's) | Dark fibre and tower networks that later enabled cheap bandwidth, cloud computing, and mobile broadband. |

Savvy investors don't sit on the sidelines. They get in early and ride the waves of growth, but also mitigate for the likelihood of a market correction by holding future-proof companies and assets.

My Playbook:

"RIDE THE WAVES, BUT HEDGE FOR RISK."

The current wave of technology innovation is creating a generational opportunity for investment and wealth creation. Instead of sitting on the sidelines, I prefer to have measured skin in the game, paired with downside protection.

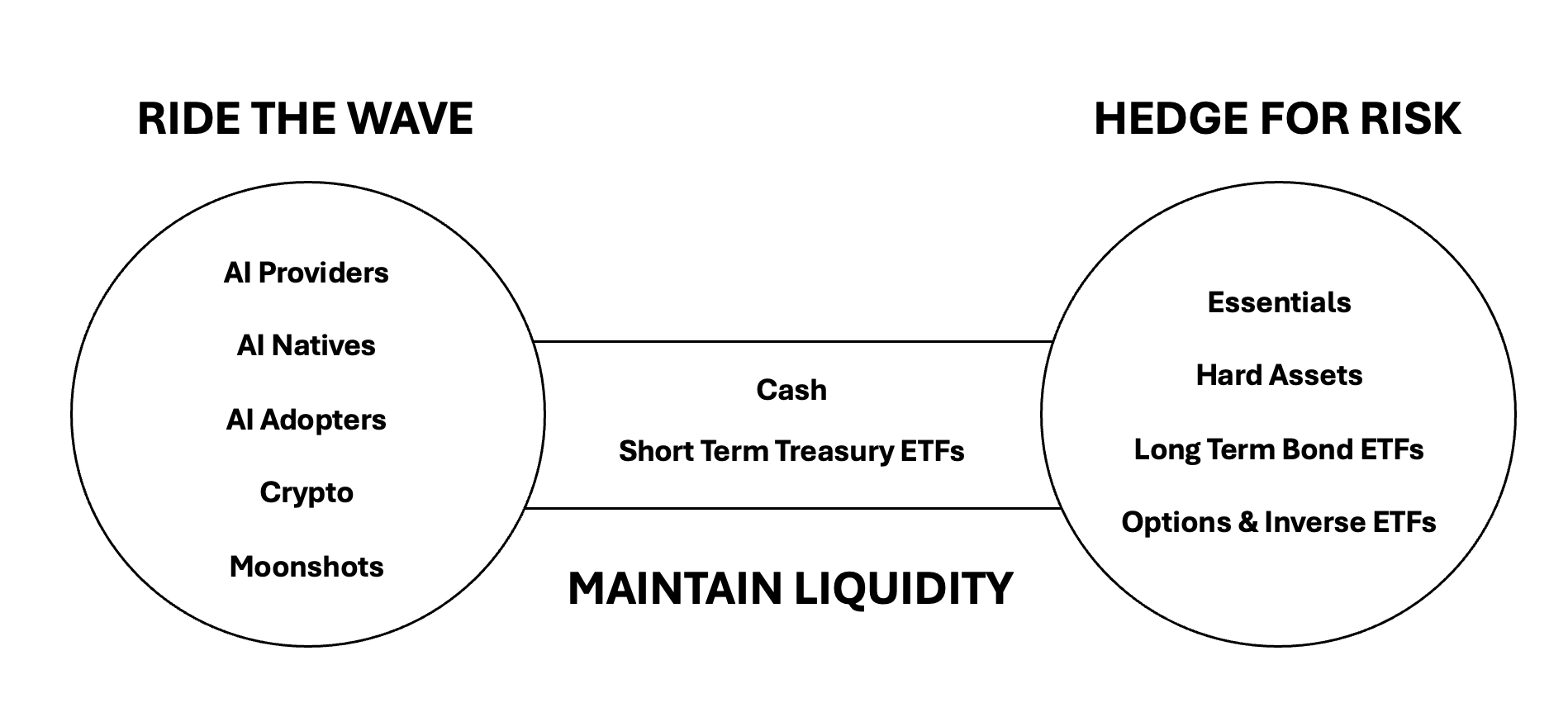

The result is a barbell portfolio, with concentrated exposure to the waves of AI-enabled growth on one side, offset by durable and often boring assets and uncorrelated hedges on the other side, with a liquidity channel in the middle to rebalance, take profits, and stay opportunistic.

1) Ride the Waves

We’re now transitioning from the AI infrastructure wave (chips, data centers, power, cooling) that fuelled the 2022–2025 bull run, into the second wave of AI‑natives (platforms and businesses built on top of the infrastructure) and AI-adopters (incumbents driving efficiencies and growth with AI).

Historically, the outsized winners often emerge in this second wave - think of Google, Netflix, etc. building on cheap bandwidth and cloud after the dot‑com bust.

The next several years will offer interesting opportunities to ride the waves across four different areas:

- AI Providers - the current frenzy of investments may slow down and much of compute could get commoditized, but the core providers of AI infrastructure (semiconductor, memory, data center, power, connectivity, etc.) will continue to monetize compute demand regardless of which AI application or model wins. Portfolio Allocation: Nvidia, AMD, Equinix, Digital Realty, Micron, Broadcom, Microsoft, Amazon, etc.

- AI Natives - these are platforms and businesses that are being built with AI at the core of the product, and include early stage companies in biotech, robotics, aviation, security, consumer tech, and more. This is also the space where most emerging companies (OpenAI, Anthropic, Mistral, Inflection, etc.) are still privately held and it is also quite possible that the founder of the next trillion dollar AI-native company is just in middle school or high school right now. Portfolio Allocation: Palantir, Tempus AI, Recursion, C3, ROBT & BOTZ ETFs, etc.

- AI Adopters - these are the traditional established firms and vertical leaders that are adopting AI to compress costs, unlock growth and create new channels. Well known names are combining their legacy strengths with AI innovation to maintain and even expand their competitive edge. Portfolio Allocation: Walmart, Costco, JP Morgan, Goldman Sachs, Siemens, Apple, Tesla, Alibaba, PayPal, Crowdstrike, etc.

- Crypto (AI Financial Rails) - the permeation of AI apps and agents across the economy will require money and value to move at the speed of software. Digital assets and blockchains will become essential infrastructure for the new AI economy where crypto provides both financial rails and a digital store of value. Portfolio Allocation: Bitcoin, Ethereum, Solana, Render, Graph, Chainlink, Bittensor, Circle, Coinbase, Robinhood, etc.

- Moonshots - history is witness that great infrastructure and technology can often get disrupted and be made obsolete very quickly. It is important to keep an eye on early stage disruptors and build some positions as a hedge - this includes companies in Quantum (to replace silicon ships), Nuclear (to replace oil and gas), and other disruptive technologies. Early-stage venture capital and private equity is also an alternative here for investors comfortable with illiquid positions. Portfolio Allocation: IonQ, Rigetti, Oklo, Teradyne, Archer, Caribou, Lightbridge, Vistra, Crisper, etc.

2) Hedge for Risk

In any boom, and we have seen this from back in the gold rush days to most recently in the dot com era, there is always a "picks and shovels" play that finds utility and sustained growth well past the hype cycle. Additionally, valuable dividend-paying companies that provide essential products and services, and that serve diversified end markets, are able to weather most downturns and bubbles.

Savvy investors will "ride the waves" but also build a safety net employing different hedging approaches:

- Essentials - these are the companies that produce products and services that will continue to be in demand whether it rains or shines - this includes big established names in energy, utilities, consumer staples, finance, construction, and industrials. Portfolio Allocation: Chevron, Dollar General, Raytheon, Waste Management, Alimentation Couche Tard, Toll Brothers, Cameco, Amphenol, Constellation, Brookfield, JP Morgan, etc.

- Hard Assets - given the current state of inflation and piles of government debt, and if one studies the lessons of the 1929 market crash, there will always be value in holding hard assets - this includes mining, metals, minerals, commodities, and real estate. Portfolio Allocation: Gold Silver Cooper Lithium Uranium ETFs, REITs, Barrick Mining, Franco Nevada, NexGen Energy, REMX Rare Earth ETF, XME Metals & Mining ETF, etc.

- Short and Long Term Bonds - another valuable lesson from history is the cyclical nature of capital markets, and so it is always advisable to have both short term liquidity as dry powder for buying opportunities, and also some exposure to long-term bond exposure as espoused in modern portfolio theory.

- Options - this approach is more tactical and meant for active traders only. You can use different options strategies (calls and puts) or use inverse ETFs to hedge for drawdowns. However, these are only tools, and not investments - so start small, learn before executing, avoid leverage, use sparingly and time‑box. Examples: Covered Calls, Cash Secured Puts, Inverse ETFs, etc.

3) The Barbell Portfolio

Visually, a portfolio that is constructed using my playbook above will look like a barbell - with different types of uncorrelated assets accumulating on both ends and a liquidity channel in the middle for portfolio rebalancing.

The percentage allocation of assets across the portfolio is a matter of individual preference, risk tolerance, and market conditions.

Personally, I like to keep between 30%-45% on the two ends and ~10-12% in the liquidity channel as dry powder for opportunities.

Conclusion

Building sustainable wealth is a long game. My approach to operating the above investment playbook is with discipline, a bias for long term value, and a constant read on where big money is actually moving - not what the headlines are saying.

Here are some pointers on how I operate the playbook to ride the waves, but hedge for risk:

- Play for the endgame: accumulate durable assets and let compounding do the heavy lifting. The endgame is to grow the assets in your portfolio.

- Avoid price-chasing and media clickbait: Decisions come from research and process, not headlines or adrenaline. It is ok to not trade for long periods of time.

- Practice “free-ride” discipline: When a position doubles, harvest the cost basis into liquidity channel (Cash or SGOV for dry powder) and let the remainder ride.

- Respect position sizing: Moonshots should stay small (0.5 - 1% each) and single-name positions rarely exceed 3 - 5% at cost.

- Favor survivorship: Strong balance sheets and contracted cash flows beat sensational narratives over the long cycle.

- Track Institutional Flows: keep an eye on what the institutions are doing - their actions reveal regime shifts long before press releases do.

Endnote: As I publish this article, on November 11, 2025, SoftBank Group announced it had divested its entire remaining Nvidia position with portfolio reallocation toward artificial intelligence software investments. SoftBank acquired their stake in Nvidia in 2017, exited for a 'free ride' in 2019, and now, they are rotating capital from AI Infrastructure (Nvidia) into AI Native Software (OpenAI). This is an early sign that AI's second wave is gaining momentum!