The Tipping Point for Web3

Behind the spectacle of crypto markets, a tech revolution to upend the social & economic dynamics of the internet is reaching its tipping point.

A Predictable Pattern

It is often said that to understand the future, one must take a look at the past. Why? because if we zoom out far enough, we can identify patterns that have been seen many times over in history. These familiar patterns can help us understand how current events are unfolding and how they will evolve into the future.

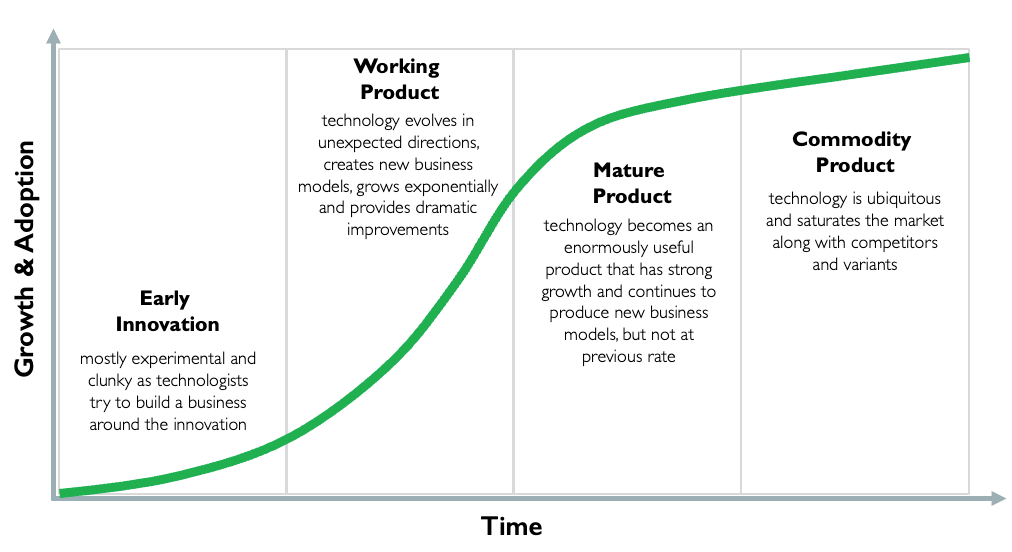

When it comes to disruptive technologies, a familiar and predictable pattern called the "Innovation S-Curve" is often observed when we look at the growth and adoption of technological innovations over time.

Since the dawn of the industrial age, most technologies that became mainstream, have followed the growth and adoption pattern of the "S-Curve" below.

Some of the most ubiquitous technologies that we use in our everyday lives and take for granted have all gone through the journey above.

Most of these innovations started as crazy experimental ideas that garnered little support, and in fact even faced active resistance, to ultimately becoming mature and useful products that changed the status quo and disrupted incumbents.

The Tipping Point

The most critical transition that technological innovations make on this journey, is the shift from being an 'early experiment' to actually becoming a 'working product'. This is when all the experimentation and progress from early-stage innovation come together into a tipping point that propels the technology into mass use and mainstream adoption.

After 10 years of experimentation and progress, the technology behind Web3 - cryptographically secured digital assets and their underlying blockchain infrastructure - is rapidly transitioning from a niche experiment into a working product that will transform our relationship with the internet.

Across the business and regulatory landscape we can now observe 5 signals, which indicate the approach of a tipping point for Web3. 👇

Signal #1 - MATURING TECHNOLOGY

With Ethereum's recent "Merge", the technical foundation is now in place for the next stage of upgrades, which will significantly improve the speed and scalability of the Ethereum blockchain over the next couple of years. The Lightning Network, built on top of Bitcoin's infrastructure, is already set up to enable fast and instantaneous blockchain-based payments. Several other blockchains (Cardano, Solana, Polkadot, Polygon, Cosmos, etc.) are also rolling out new infrastructure for improving the speed, scale, and security of Web3's foundational layer.

Why it matters? Decentralized applications, built on high-performance Web3 infrastructure and interoperable with existing financial markets, will facilitate the day-to-day access, usage, and adoption of Web3/Crypto.

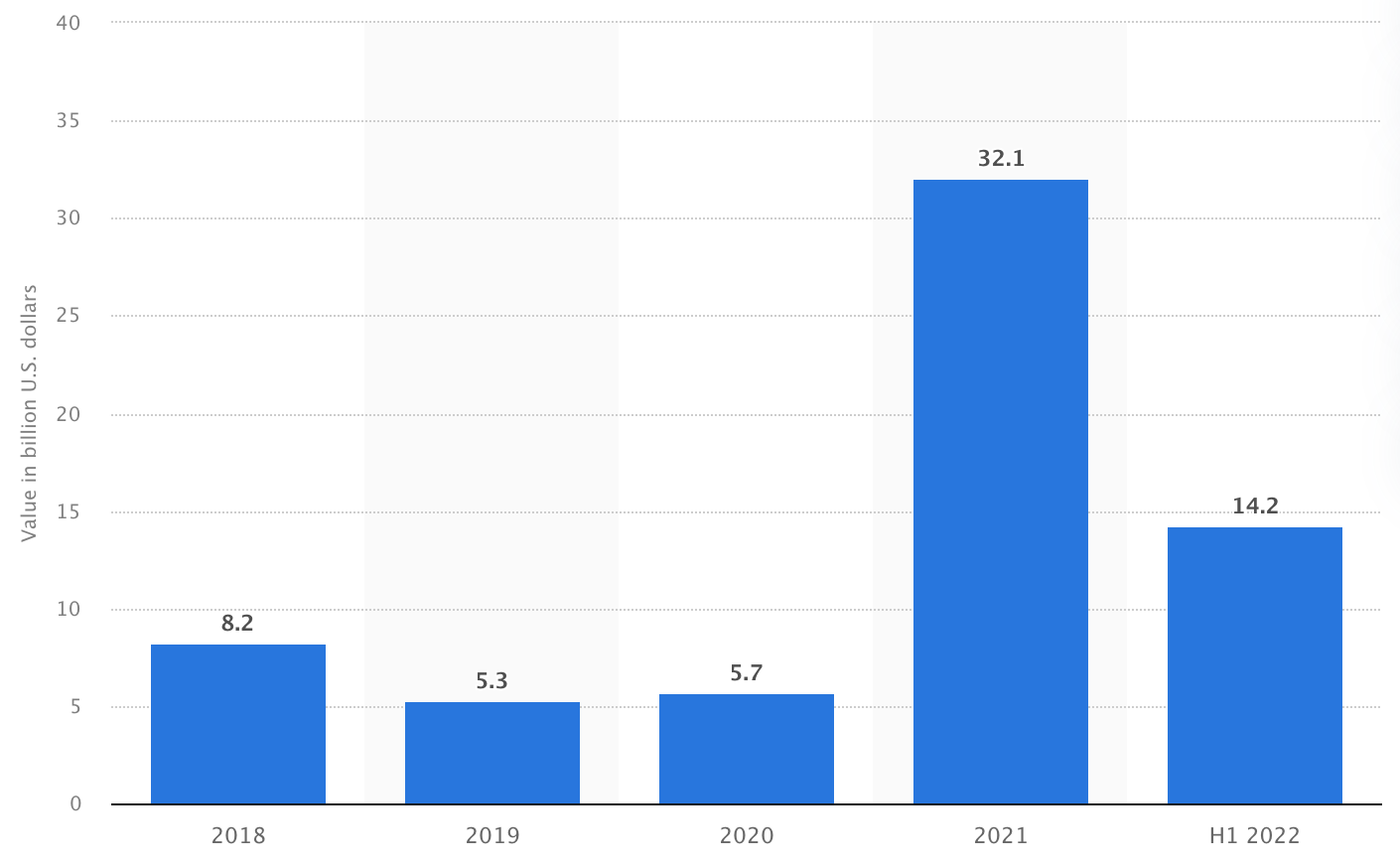

Signal #2 - FLOW OF CAPITAL

Globally, VCs invested over $32 Billion in 2021 into the Crypto and Blockchain sectors. In 2022, while the pace of investment has slowed down due to macroeconomic conditions, the funding to develop ideas and products still continues to flow for promising projects and startups.

Why it matters? The flow of capital into this space will fund innovation, R&D, product development, and support companies that are working on key problems that are standing in the way of Web3 mass adoption.

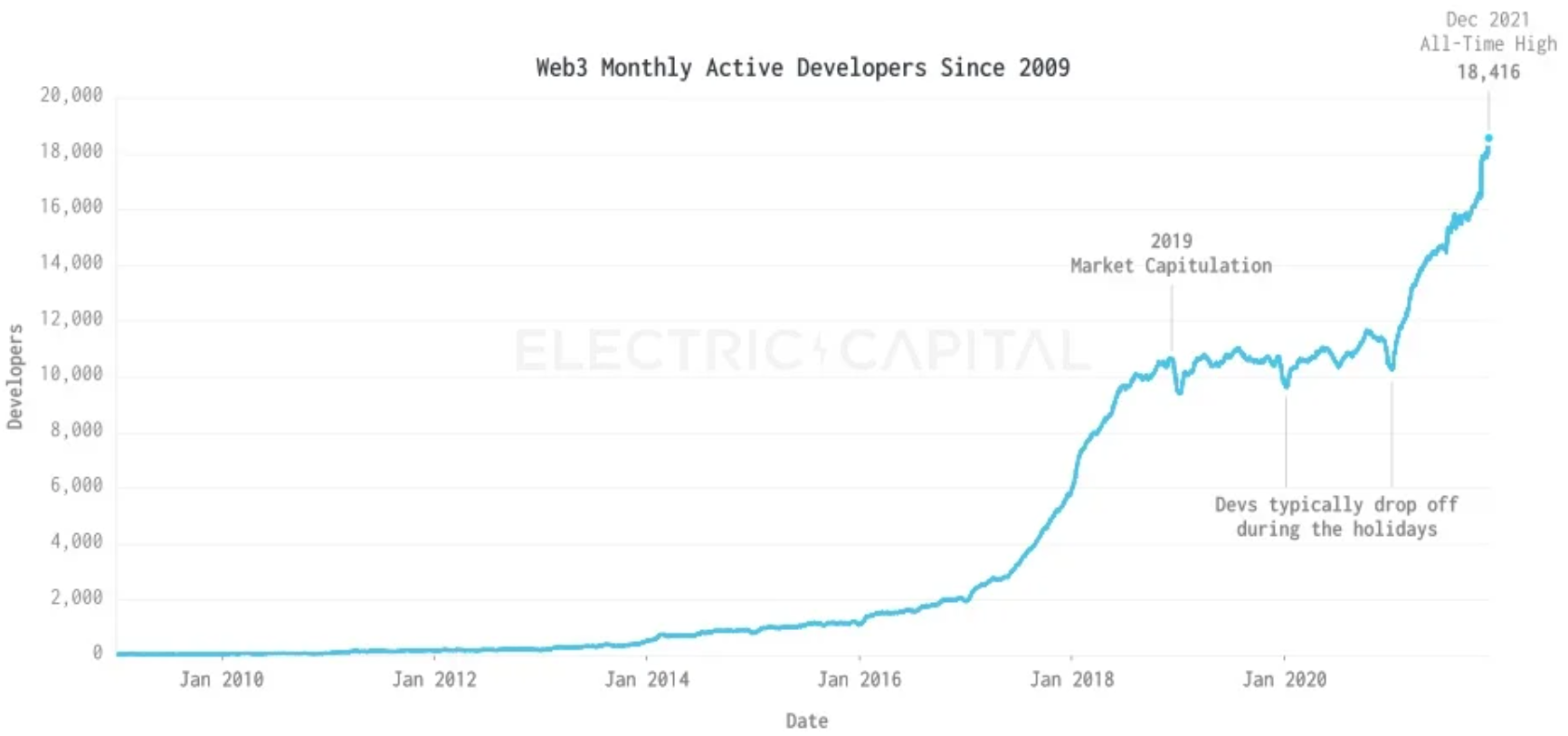

Signal #3 - FLOW OF TALENT

Since most of the development work in Web3 is open-source, the level of developer participation and coding activity can be tracked by viewing public data. GitHub data on 'code commits' made by developers to Web3/Crypto projects shows strong growth, which is a good proxy for the inflow of technical talent into the space.

Why it matters? The inflow of human capital unleashes talent and resources to work through the tough technical and business challenges in taking Web3 from the experimental stage to a mature working product.

Signal #4 - USE CASES

As the underlying technology matures, many innovative use cases that have been imagined, proposed, and piloted by Web3's early adopters can actually start being implemented at scale.

Decentralized Autonomous Organizations (DAOs): provides ways for community governance of any kind of organization.

Decentralized Finance (DeFi): provides the ability for individuals to access and create financial products, regardless of their geography or profile.

Decentralized Identity (DID): provides the ability for individuals to issue, hold, and control their digital identity and port identity data across applications.

Decentralized Social (DeSo): provides new blockchain-based social media networks that are open, censorship-resistant and allow ownership of content.

Decentralized Data: provides public infrastructure and tokenized incentive mechanisms for creating, contributing, publishing, and consuming data.

Decentralized Gaming / Metaverse: provides digital worlds and experiences that allow for ownership and portability of gaming assets and virtual real estate.

Non-Fungible Tokens (NFTs): provides digital proof of ownership and authenticity, which will revolutionize art, music, real estate, and much more.

Why it matters? The deployment of decentralized blockchain-based technology to solve real-life problems and emerging new use cases will drive further adoption, growth, and mainstream awareness of Web3.

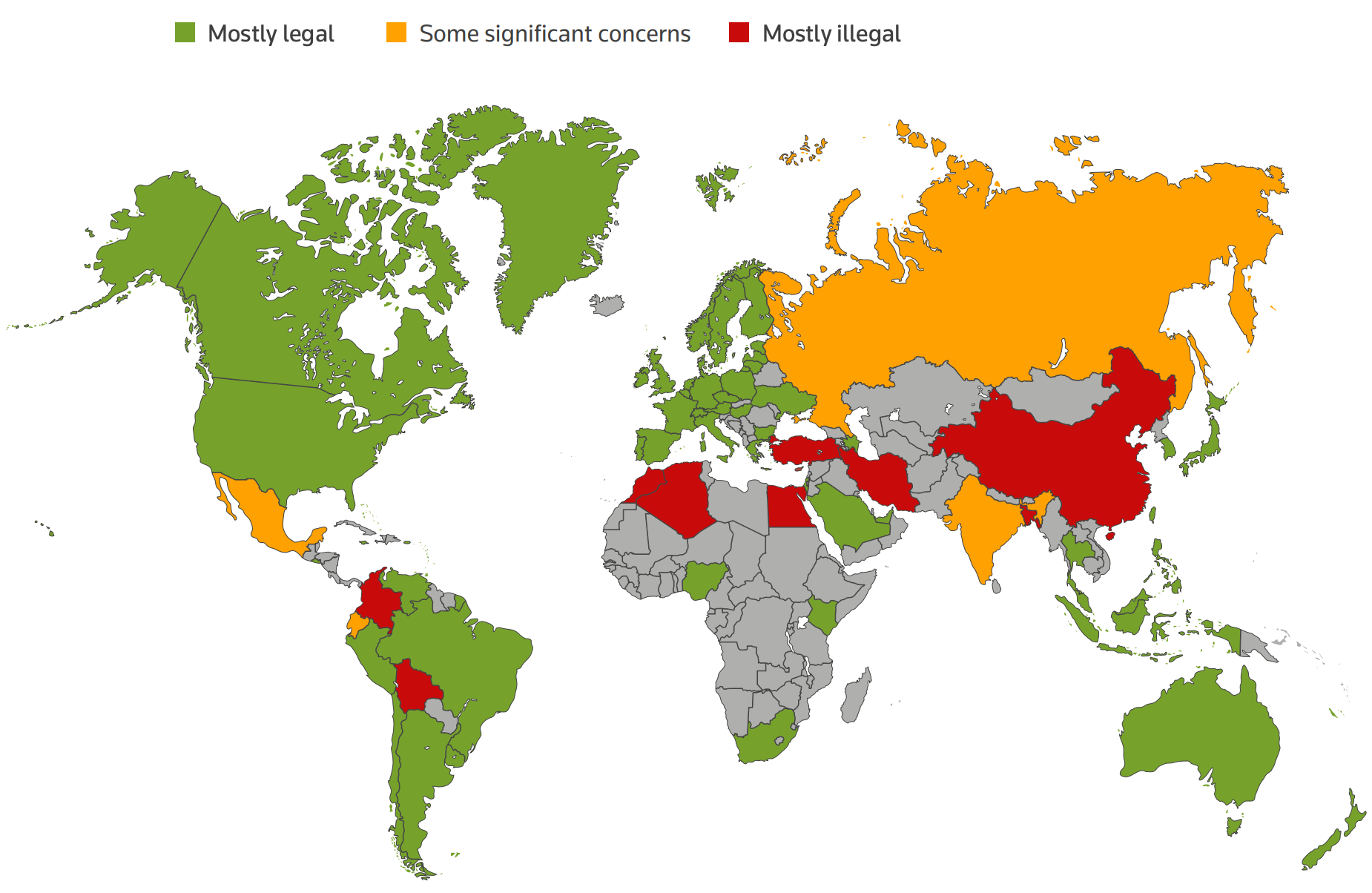

Signal #5 - REGULATIONS

Early innovations of the industrial era, such as cars and airplanes, did not reach mass markets and broad adoption until safety regulations were implemented. Policies for consumer protection were crucial for gaining public confidence, which then drove mainstream adoption of these new technologies and products.

Similarly, a clear regulatory framework for crypto markets is necessary for bringing mainstream credibility to digital assets (tokens, cryptocurrencies, stablecoins, etc.) that will power the Web3 economic engine.

In the United States, starting with a Presidential Executive Order signed in March 2022 for "Ensuring Responsible Development of Digital Assets", there are now over 50 bills related to crypto assets, currently in US Congress.

In the EU, the European Parliament passed an overarching proposal for crypto regulation in June 2022, called MiCA (Markets in Crypto Assets).

Across the world in different jurisdictions, crypto industry representatives and policymakers continue to be engaged in active dialogue, to develop regulatory frameworks for this emerging asset class.

Why it matters? With the support of clear regulations and policies, the underlying blockchain technology behind Web3 has the potential to radically change financial/monetary systems and the internet economy.

A Web3 Future

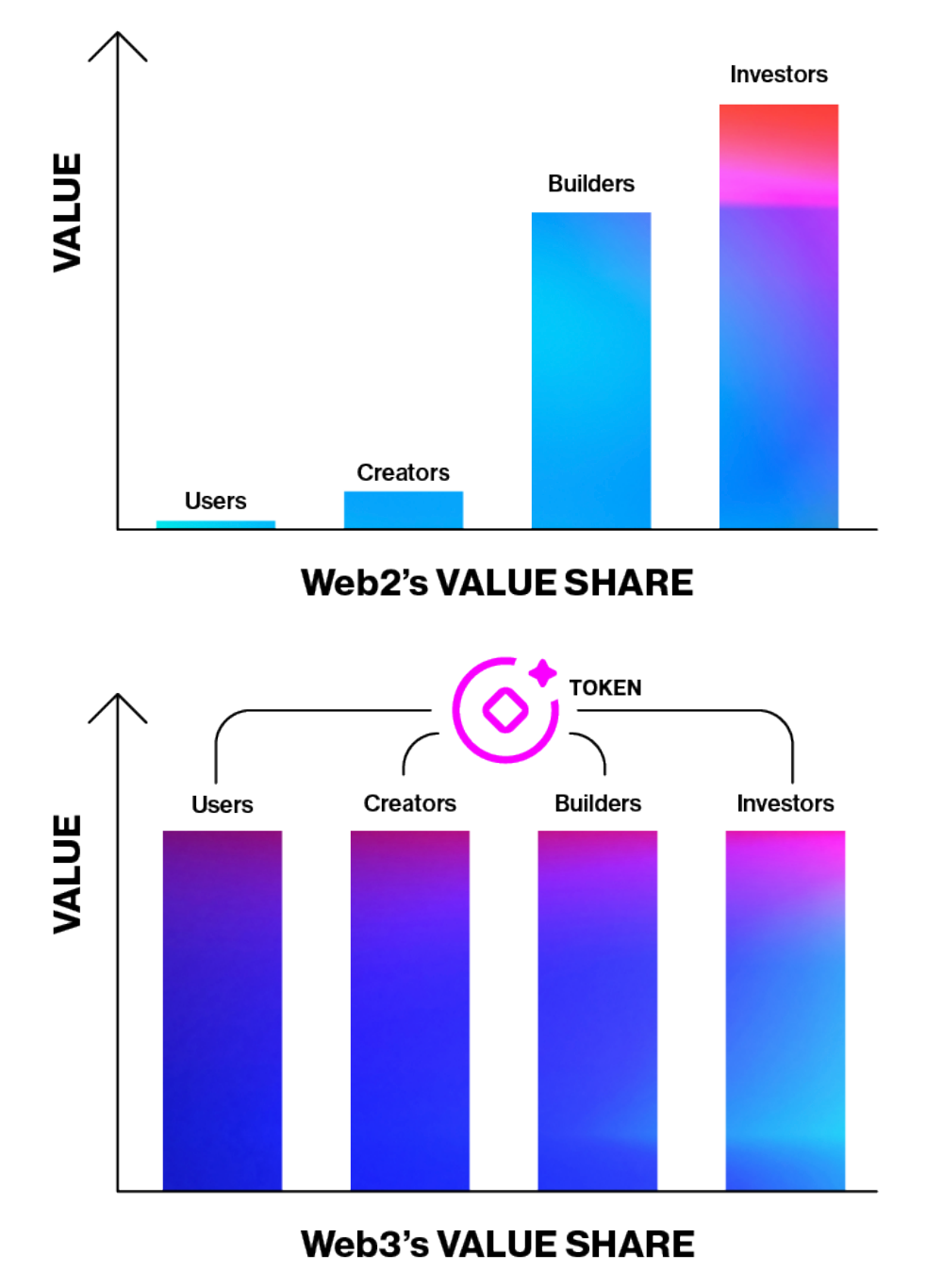

At its core, the idea behind Web3 is to use blockchains, cryptocurrencies, and NFTs to create a better, fairer internet. With Web3, we can all 'own' a piece of the internet and this gives power back to internet users and creators in the form of ownership and digital property rights.

A Web3 future will take the focal points of human engagement on the internet and through decentralization and digital tokens, it will empower users, builders, and creators in a revolutionary way - one that flips the script and enables value accretion in their favour.

CONCLUSION

The vision of Web3 is bold, disruptive, and revolutionary.

Web3 is reaching its tipping point.

Over the next few years, the movement toward a decentralized internet and digital ownership will have massive impacts on business and society.

It is time to start thinking about how YOU will participate in this movement!