Finding Quality in the Clutter

A toolkit to help crypto investors discover quality assets and make investment decisions in the face of overwhelming choice and unfiltered information.

Disclaimer: The information in this article is for educational purposes only and should not be misconstrued as a recommendation to purchase any tokens. This is not investment advice. Please do your own research before investing.

The Choice Explosion

Over the past two years, government policy, economic climate, and rise of the digital economy has made cryptoassets highly desirable for forward-thinking investors who want asymmetric investment and growth opportunities.

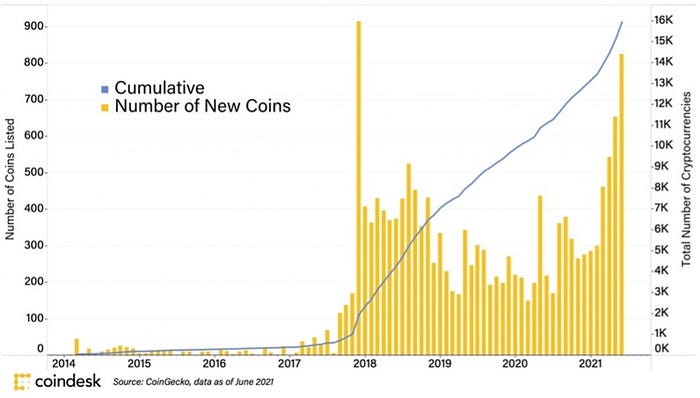

However, investing in crypto was a much easier task 4–5 years ago when the entire digital asset ecosystem was made up of less than 100 assets.

Fast forward to June 2022, and we have an investment landscape with over 19,000 assets and a market capitalization close to $1 Trillion.

The prospect of opportunity, wealth, and billions of dollars in venture capital has poured jet fuel over the past few years on the crypto sector. This has been great for driving innovation and nurturing valuable projects that will become the infrastructure, service, and application staples of the new digital Web3 economy that is being built on crypto and blockchain technology.

Unfortunately, cheap venture capital, the permissionless nature of public blockchains, unclear regulation and just pure human greed are also responsible for flooding the crypto markets with thousands of questionable digital assets that are riding the hype to make quick money, and have no real use case, economic utility, or technology innovation behind them.

In today’s world, it doesn’t take much effort to float a digital token and deploy an army of social media campaigns and paid influencers to phish eager retail investors into ‘pump and dump’ schemes.

Information flow in the crypto space is often scattered, noisy, and biased. However, hidden in that deluge of opinions, token shilling, analysis, white papers, community chats and technical data are the signals to identify digital assets that hold the promise of innovation, utility, and lasting value.

The crypto investor’s challenge is to discover high quality tokens and make investment decisions in the face of overwhelming choice and unfiltered information.

How to find quality in the clutter?

The rise of cryptoassets has been compared to the advent of internet in the 1990’s, that forever altered our daily lives and businesses. However, as with any disruptive innovation, crypto is experiencing the expected rites of passage — growing pains, opportunism, and highly volatile market cycles of booms and busts, before it achieves stability, mainstream adoption and acceptance.

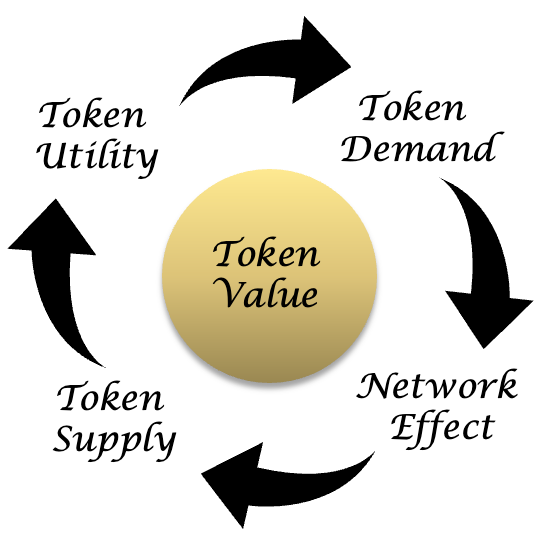

As crypto matures, the factors that will drive its success are identical to those of any other business venture, where value is created by positive feedback loops of Utility, Demand, Supply & Network Effect. Companies like Amazon have successfully used this flywheel strategy to drive exponential business growth over the past two decades.

The savvy investor must ask the following questions to critically evaluate digital assets being considered for long-term investment:

1. What is the utility of this digital token?

2. Is there any demand for this digital token?

3. How is the supply managed for this digital token?

4. How is the digital token allocated and distributed?

5. How strong is the network for this digital token?

6. Does the use of this digital token and decentralized tech improve or disrupt current business models?

Let's Evaluate Ethereum

To illustrate this toolkit with an example, I will take a market leading cryptoasset like Ethereum and put it in the hot seat — evaluating its native token Ether using the toolkit of six questions described above.

1. What is the utility of Ether?

As the native digital currency of the Ethereum blockchain, Ether (ETH) serves three essential purposes:

(i) Act as a store of value,

(ii) Settles transactions by allowing users to send/receive payments, and

(iii) Serves as fees for using on-chain computation and data storage.

More details on Ether (ETH) can be found on Ethereum Foundation: https://ethereum.org/en/eth/

In depth, technical details of how Ethereum operates as a decentralized world computer are provided in the platform’s white paper: https://ethereum.org/en/whitepaper/

2. Is there market demand for Ether?

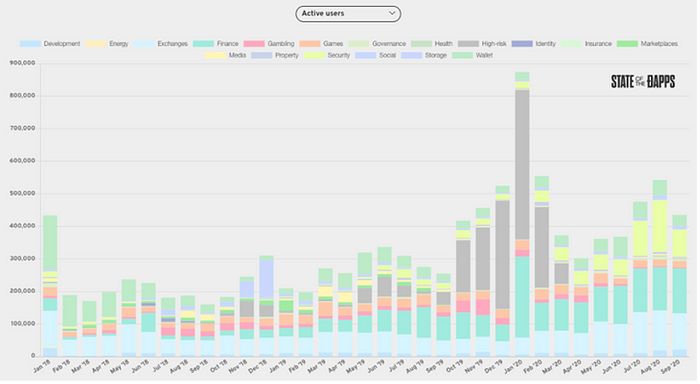

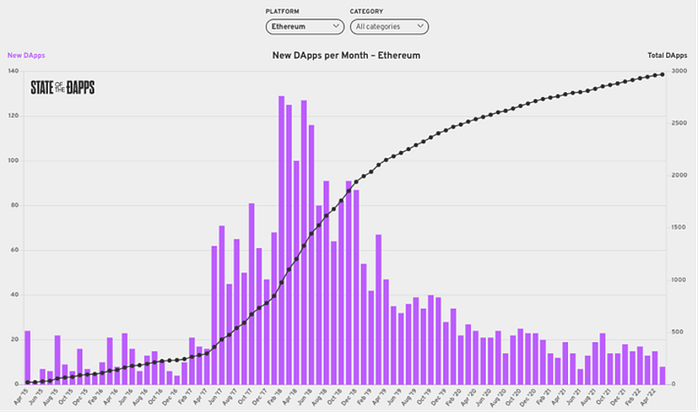

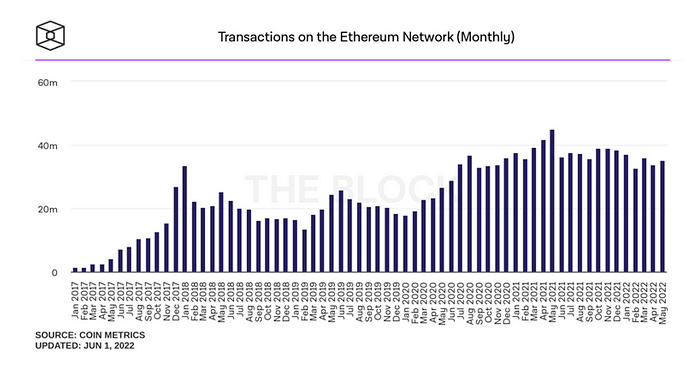

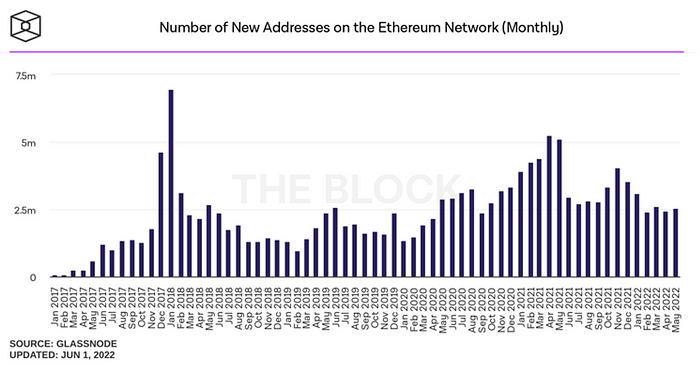

The number of active users and new applications being launched is a very good proxy for the demand of the native token of the underlying blockchain. Ethereum has seen consistent demand since inception.

3. Is the supply of Ether designed to create deflationary pressure?

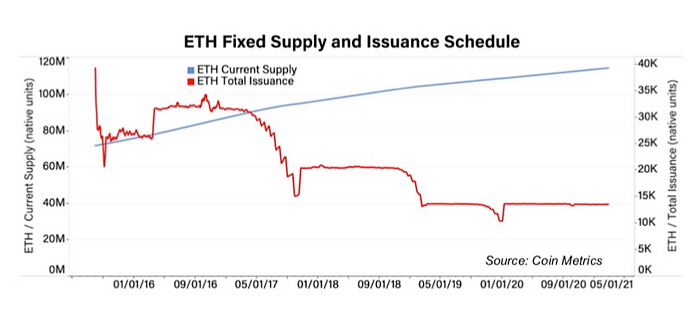

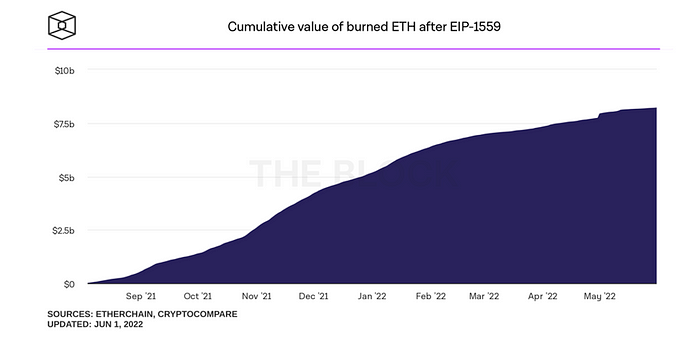

Even though Ethereum was originally developed without an ETH supply cap, over the years, as Ethereum has evolved via community inputs and Ethereum Improvement Proposals (EIPs), a more active deflationary mechanism is progressively being implemented.

This supply scarcity mechanism started with EIP-1559 and has now been fully rolled out with the “Merge” on September 15, 2022 of Ethereum Mainnet and Beacon Chain as a part of the Ethereum roadmap to move to Proof of Stake.

4. Does Ether have fair distribution?

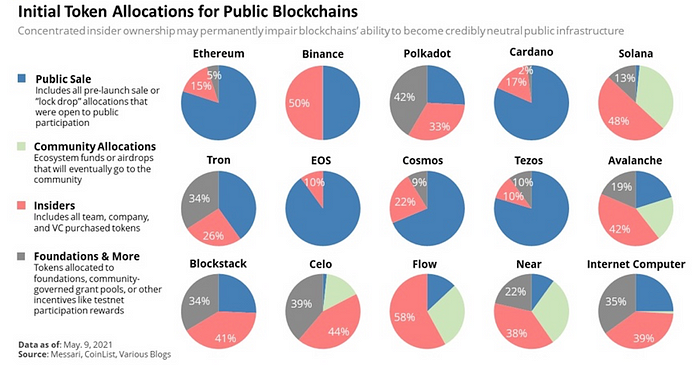

Since value is stored and transacted through digital tokens in public, decentralized, blockchain based systems, it is important for investors to know how tokens are allocated and distributed. In this regard, the initial allocation of ETH tokens is one of the most neutral in the entire crypto industry.

5. Does Ethereum have a strong network?

From the onset, Ethereum has been very successful in attracting new users (measured as new addresses on the network) and maintained a healthy growth in the number of transactions. As of May 2022, the Ethereum blockchain has over 14 Million blocks committed, and growing.

6. Does Ethereum disrupt traditional business models?

Ethereum provides a permissionless and decentralized world computer that anyone with an internet connection can utilize to create and distribute global software applications. The Ethereum blockchain provides everything from storage and computation infrastructure to an open-source programming language and broad developer community support for this purpose.

Using the Ethereum platform, enterprising developer communities have created numerous disruptive applications that provide decentralized financial services, run decentralized organizations, with new and innovative applications and use cases being created on almost a daily basis.

Readers can see from the “Six Questions” analysis above that Ether (ETH) has real utility, robust demand, efficient supply mechanism, strong network growth, fair token allocation and uses blockchain to revolutionize existing web infrastructure with a decentralized world computer.

Crypto Is A Great Opportunity...But Buyer Beware!

Crypto is a new and maturing asset class with tremendous long-term upside potential. This is why innovative investors are looking at increasing exposure to this asset class in their wealth portfolios.

However, given the volatility of crypto markets and unclear regulatory landscape, the concept of caveat emptor or ‘let the buyer beware’ applies to all digital assets. Unlike the equity markets, there are no Federal bailouts to make up for any investor losses in crypto.

The onus therefore lies on investors in the space to mitigate their risk with the following:

DYOR and Diversification

DYOR stands for “Do Your Own Research” and is a common phrase used in the Crypto space. However, the acronym is not exclusive to crypto and is applicable for most digital media, given how fast and easily misleading information spreads on the internet and social media these days.

Unfortunately, there are many uninformed investors in the crypto space, who follow hype and influencers to make investment decisions. DYOR is essential to understand a cryptoasset before investing, so you can answer precisely why you are buying that asset and supporting the underlying crypto network.

Diversification of assets is also a crucial and “must do’ risk management technique. It is never safe to put all your eggs in one basket and especially so in a highly volatile space such as crypto.

Over the years in crypto, while HODL (meme term to keep holding your assets) has become daily vernacular, there are also many stories of retail investors who have lost everything because they did not diversify across multiple digital assets. Recently, this is even more in the spotlight with the Terra and UST crash, where numerous retail investors unfortunately lost their life’s savings that were all invested in the LUNA token.

Navigating Uncharted Waters

Investors who are just dipping their toes in crypto, can start by vetting 4–5 cryptoassets using the “Six Questions” toolkit and then slowly keep growing their portfolio by increasing exposure and diversifying to additional assets.

Crypto markets have always been volatile and many investors have had a front row seat on this rollercoaster in 2021 and 2022. Therefore, it is advisable to always do dollar cost averaging when entering the market.

Also, another good practice is to book profits on digital assets that have a good run in the bull market cycle and then invest the surplus capital on diversification into other high quality digital assets.

The volatile nature and unclear regulatory landscape of crypto markets can be unnerving, but investors should remember that this is still an emerging asset class. It will take some time before the digital asset markets grow, stabilize and become mature and regulated like equities and commodities.

Crypto has been going through a bear market in 2022 because of current economic conditions and policy, but opportunistic buying of high-quality undervalued cryptos and patience will bear fruit for investors who take a long-term view on the value created by digital assets.

Forward thinking investors who take informed risk and accumulate high quality cryptos in their portfolio will see benefits from the value appreciation of these digital assets, as they slowly gain mainstream adoption and go on to become the staple commodities and currencies that will power Web3 digital economy in the future.

This article is also available as an NFT collectible https://mirror.xyz/nmathur.eth